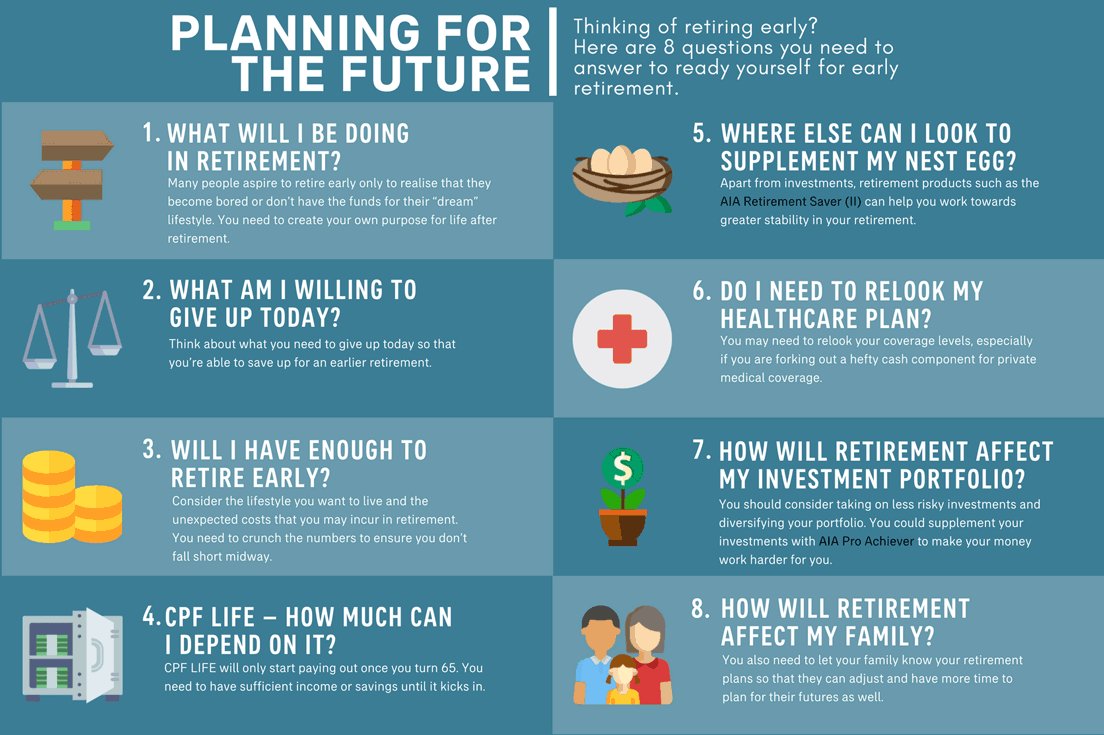

Seeing so many success stories on social media, many Singaporeans fantasize about early retirement. Here are 8 questions you need to answer to ready yourself for early retirement.

If you're daydreaming about an early retirement, you aren't alone. The idea of spending time pursuing your interests and passions might sound attractive now, but before you decide to hand in the last resignation letter in your career, you need to ensure you have a retirement plan that will hold up throughout your retirement.

To work towards an early retirement, you need to start planning early. This is because you're going to need to be more prudent and productive during the earlier years of your working life in order to achieve an early retirement in Singapore, one of the most expensive real estate markets[1] and countries to live in[2].

To prepare for one of the biggest life changing decisions you'll make, here are eight questions you need good answers to before taking the plunge.