This article was originally published on 25 September 2020 and updated with new information.

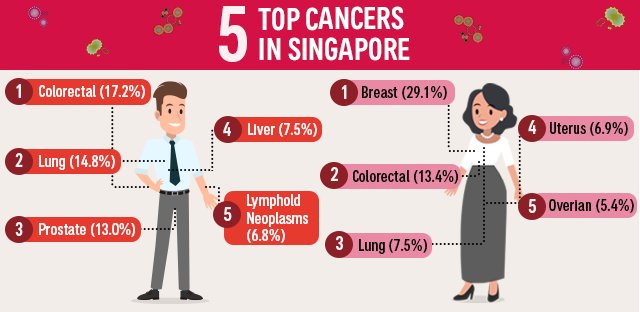

Discussing cancer can be a morbid topic people might prefer to avoid. However, the fact is that cancer remains the leading cause of death in Singapore since 2016. It is estimated that 1 in every 4 or 5 people in Singapore may develop cancer in their lifetime.

While the probability of being diagnosed with cancer may increase with certain lifestyle choices and exposure to carcinogens, or may be hereditary, there isn't a single cause and it can strike anyone.

Nevertheless, there are steps you can take to protect yourself against cancer.