Let's find out your willingness and ability to take risks.

This allows us to recommend an investment portfolio

that is suitable for you.

This allows us to recommend an investment portfolio

that is suitable for you.

VIEW

RESULT

RESULT

Based on the risk assessment,

the recommended portfolio for you is

the recommended portfolio for you is

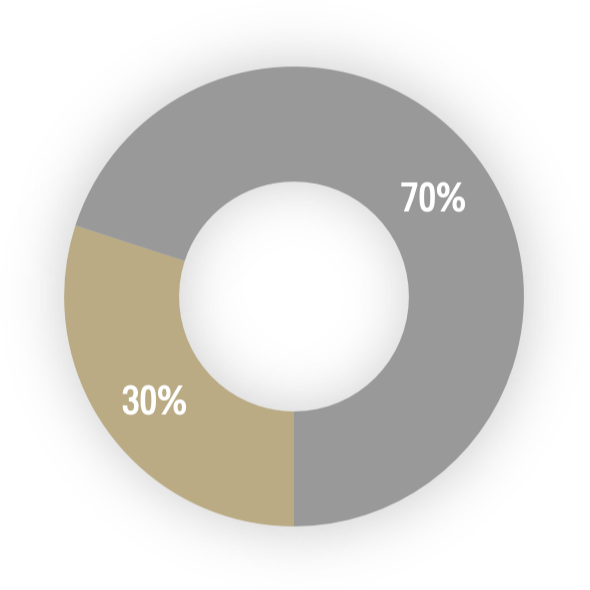

AIA Elite Conservative

(Higher) Illustrated Rate of Return: 5.8%

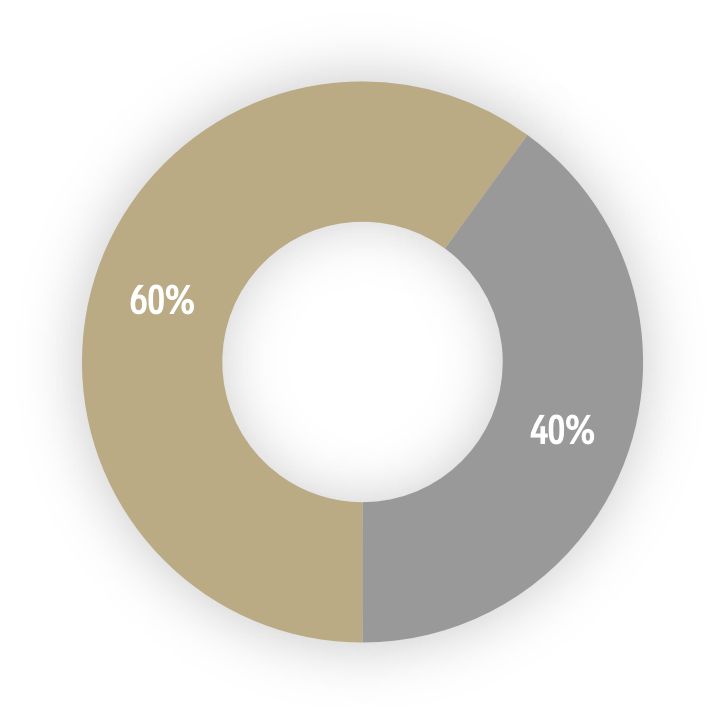

AIA Elite Balanced

(Higher) Illustrated Rate of Return: 7.2%

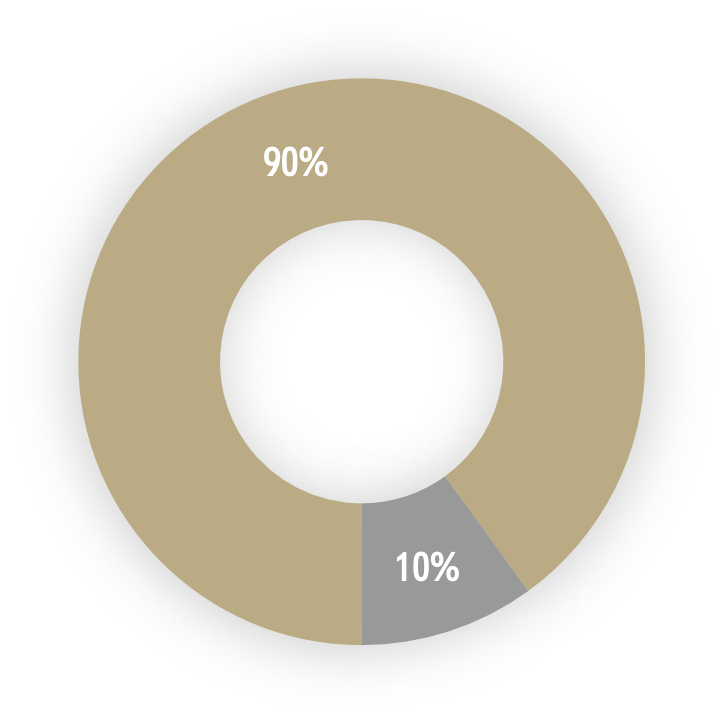

AIA Elite Adventurous

(Higher) Illustrated Rate of Return: 8.0%

- Fixed Income

- Equities

The (lower) Illustrated Rate of Return for the 3 portfolios is at 4.0% p.a.